No security is worth more than the present value of its future cash flows…

VALUATION

Project, Business & Securities Valuations Reporting Overview

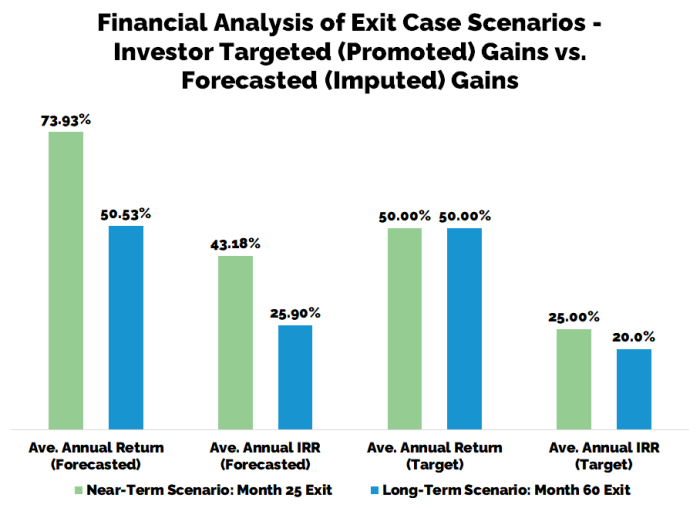

The valuation process is intended to support collateral underwriting due diligence reviews, yet all valuation reporting rests on valuation models. It may pay to remember the fact, “all models are wrong, but some are useful.” RTMS addresses this issue head-on in the valuation reporting process by combining multiple valuation methodologies in order to establish a value range that may form the basis for concrete decision-making on the deployment of capital.

Whether you are undertaking a sale, a recapitalization of an existing business, seeking construction financing, or considering an investment opportunity as an investor, the valuation reporting has to provide a basis for common understanding by all parties. RTMS reporting seeks to provide this desired outcome. Our report is a 15-page snapshot that provides the value ranges for a modest fee. Production time is typically 2 to 5 days.

Contact

Get the ball rolling…

Fill out the contact form bellow and schedule a consultation!